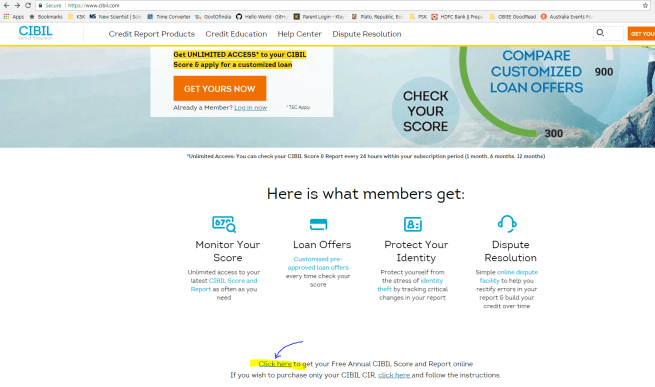

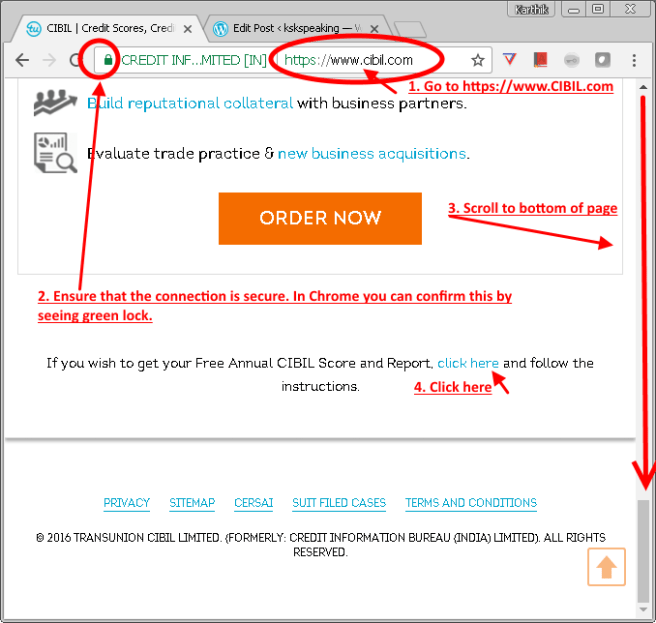

Click here if you just want the steps and no stories. This is how you get an absolutely FREE credit score and report from CIBIL.

I have been checking my credit score once a year since Jan 2012 and I plan to continue doing so going forward. It has been a healthy report every year so why should I bother checking it repeatedly?

Iron out inaccuracies

In my first report I noticed that the education loan that I had closed after prompt payment, was indicating missed EMIs. The bank had moved all education loan numbers from their old format which was like ELxxxx15 to something like 111222333xxxx15. So my credit report had two education loans. One ELxxx15 which showed proper EMIs till the date when the account number was changed. Another 111222333xxxx15 which showed proper EMIs only after the date when the account number was changed.

I contacted the bank branch and they feigned ignorance of the issue. I then sent them a mail with all the contents and requested them to update the necessary channels so that my credit report doesn’t look bad to a person who doesn’t care about the bank’s internal reasons. In 2 months, I got a response from the bank stating that the issue had been sorted. I checked my credit report again and this time my score was higher and the discrepancy was corrected.

Credit card applications

Yea! That’s right. In my first report taken in Jan 2012, I also noticed how many credit cards I had applied for. That’s a bit scary. Anyone who knows the credit-score game will tell you that multiple credit checks by credit providers such as banks for loans and credit cards will actually bring down your credit score. So it is good to keep a watchful eye (once a year is sufficient for me now).

See the outcome of your financial discipline(or the lack of it)

That doesn’t need an explanation so I’ll move right ahead.

Free report

For a few months now, I’ve been waiting for Jan 2017 to begin. Jan is when I apply for my credit score each year. Jan 2017 is even more special because of announcements citing ‘one free credit score report from 2017′(Refer links [1][2][3]). Now that I’m here, I’m going to record the process and share it with you so that the elusive promised report is actually attainable. Carefully note that there is still an option to get it by payment, even if it is your first report for the year.

When you click the link, a new page/tab will open. In Chrome, you can hover your mouse at the top of the page and use the download link to download the pdf. You can alternatively print it right away 🙂

Just fill the details and send it to their address mentioned at the bottom of that pdf. I just sent mine. I’ll update this post when I get my report. Not sure if I’ll get it by email or in my postal address.

UPDATE:

I got the credit report by email. Roughly 7 working days after I applied through snail mail.